Discover the very best Car Insurance in Dallas

Leading Variables to Think About When Finding Car Insurance

When it pertains to opting for car insurance policy, one of the essential elements to look at is actually the insurance coverage choices given by different insurer. Not all plans are developed identical, so it is actually important to recognize what each program excludes and features. Some policies may give standard protection for obligation just, while others might give additional complete insurance coverage that features defense against theft, vandalism, and all-natural disasters.

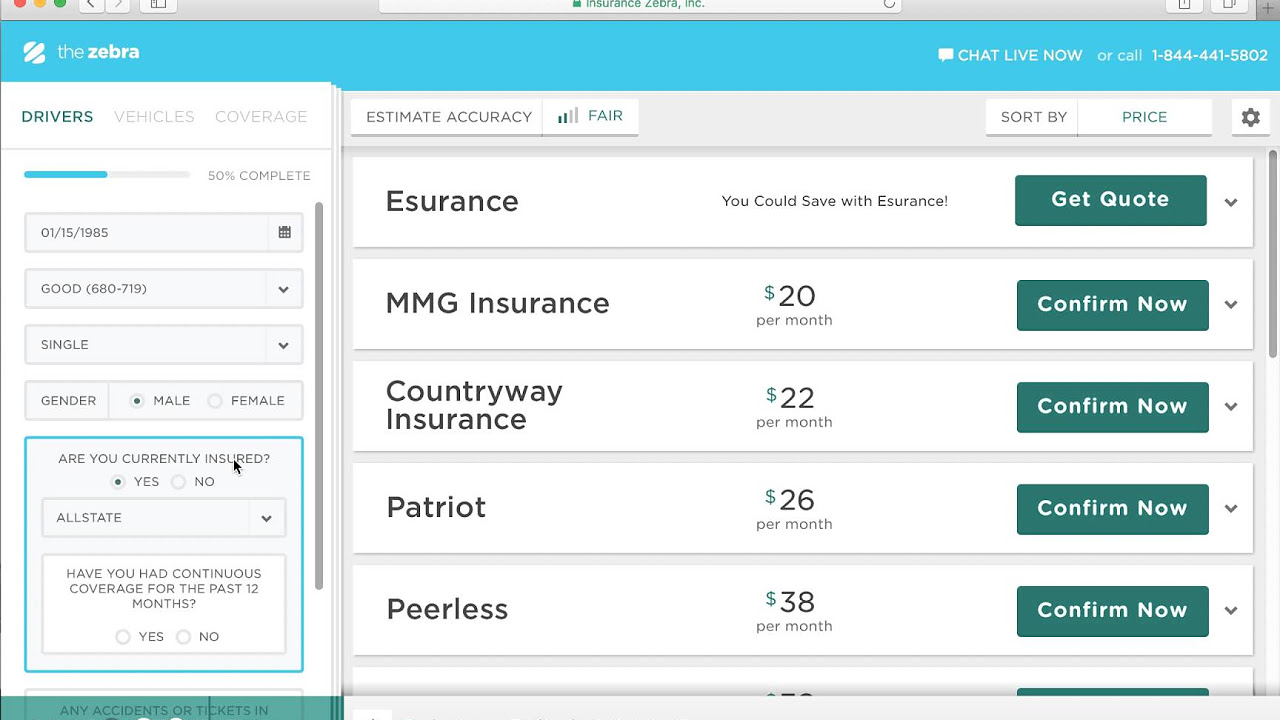

An additional essential element to take into consideration is the cost of the insurance coverage superiors. Superiors can differ substantially based upon variables like the driver's grow older, driving past history, sort of vehicle, and area. It is actually vital to compare quotes from several insurance coverage service providers to guarantee you are acquiring the greatest coverage at a reasonable cost. Furthermore, look at any price cuts or even exclusive offers that may be actually on call to assist lower your insurance prices.

Factors That Affect Car Insurance Policy Fees in Dallas

When determining fees, car insurance coverage prices in Dallas can be determined by a range of factors that insurance providers take into factor. One crucial factor is the driver's age, as much younger drivers are actually commonly billed greater costs as a result of to their lack of steering experience as well as raised possibility of being actually included in crashes. Furthermore, the style of car being actually guaranteed can easily affect rates, with even more costly or high-performance vehicles usually leading to higher costs. Another crucial factor is actually the driver's previous driving document, including any kind of past history of accidents or traffic infractions, as this can signal to insurance providers the level of risk related to covering that person.

Moreover, where a driver resides in Dallas may additionally impact car insurance coverage costs, as specific areas might have greater prices of incidents or vehicle burglary, triggering increased premiums for citizens in those communities. Also, a driver's credit history can play a duty in identifying insurance coverage fees, as individuals along with reduced credit rating might be actually considered as greater risk as well as demanded much higher superiors therefore. Through comprehending these factors that can easily impact car insurance coverage costs in Dallas, drivers could be a lot better readied to get through the insurance coverage market as well as potentially locate techniques to lessen their premiums.

Tips for Conserving Cash on Car Insurance in Dallas

Among the most effective means to spare cash on car Insurance Navy Brokers insurance in Dallas is actually by boosting your insurance deductible. Through picking a higher tax deductible amount, you may decrease your regular monthly premium substantially. However, it is necessary to guarantee that you possess the financial means to cover the deductible in case of a crash.

Yet another suggestion to consider when wanting to conserve cash on car insurance in Dallas is actually to benefit from savings delivered by insurer. Lots of insurance companies provide discount rates for a variety of reasons including having a tidy driving record, being a trainee along with really good qualities, or also bundling various insurance policy policies together. Through looking into these price cut possibilities, you might have the ability to decrease your total insurance coverage expenses while still maintaining the coverage you need.

Comprehending the Various Sorts Of Car Insurance Insurance Coverage

When it happens to car insurance policy coverage, it is actually critical to recognize the various types that are actually accessible to ensure you have the right protection for your vehicle. Obligation insurance policy is actually an obligatory style of protection in the majority of states, including Texas. This style of insurance policy helps cover the expenses connected with harm or even accidents you might create to others in an incident where you are actually at error. It usually features physical accident responsibility, which deals with clinical expenditures, and residential or commercial property damage responsibility, which covers harm to other vehicles or building.

Comprehensive coverage, on the various other palm, assists purchase harm to your own vehicle that is not led to through a collision. This could possibly feature theft, vandalism, organic calamities, or hitting a pet. Collision protection is actually another vital kind of insurance coverage that deals with the expense of repairs to your very own vehicle in case of a crash along with one more car or object. These forms of insurance coverage, in addition to others like uninsured/underinsured vehicle driver protection as well as private trauma protection, supply a series of securities that can easily provide you assurance when traveling.

Exactly How to Match Up Car Insurance Quotes in Dallas

When reviewing car insurance policy prices estimate in Dallas, it is necessary to gather quotes coming from numerous insurance providers to guarantee you are actually obtaining the most ideal offer. Keep in mind of the protection choices supplied through each firm and compare them parallel to comprehend what is actually consisted of in each policy. See to it to take note of the deductibles, limitations, as well as any added benefits or even markdowns that may be readily available.

Also, consider the image of the insurer as well as their client service record. Reading through reviews as well as inquiring for recommendations from loved ones may give valuable knowledge into the business's dependability as well as cooperation. Take your time to review not just the price of the insurance coverage however likewise the level of company and also help you can get out of the insurance policy carrier.

Common Blunders to Prevent When Acquiring Car Insurance

A lot of drivers create the blunder of exclusively paying attention to the cost of car insurance coverage when making their decision. While cost is actually a necessary factor, it should not be the only factor to consider. It's essential to also analyze the insurance coverage choices delivered through various insurance coverage providers to guarantee you possess adequate security in situation of a collision or even other unpredicted occasions.

Yet another typical blunder to avoid is certainly not examining your plan consistently. Your steering practices, gas mileage, as well as also the market value of your car can easily modify in time, impacting your insurance policy requires. Through on a regular basis evaluating your plan as well as discussing any type of adjustments with your insurance policy supplier, you can make certain that you are actually thoroughly covered and also might even find possibilities to conserve cash on your costs.

The Significance of Customer Support in Car Insurance Policy Companies

Excellent customer care is actually an essential variable to consider when analyzing car insurance policy business. In the competitive car insurance coverage industry, excellent customer solution can make a notable difference in an insurance policy holder's experience. Coming from without delay addressing insurance claims and concerns to supplying very clear as well as valuable guidance, first-class client service may enhance consumer fulfillment as well as loyalty.

Exactly how to File a Car Insurance Insurance Claim in Dallas

When filing a car insurance policy claim in Dallas, it is necessary to follow the appropriate steps to make sure a hassle-free method. To begin with, call your insurance business immediately after the case happens. Be readied to supply particulars such as the day, time, and also place of the mishap, as properly as the titles and connect with relevant information of some other gatherings involved. Your insurance policy agent will guide you through the next steps, which might include supplying records such as photos of the damage, a cops file, and also any type of appropriate case histories.

Once you have actually submitted all the essential info, your insurance provider will examine the insurance claim as well as figure out the protection as well as advantages you are actually allowed to acquire. It's crucial to keep in communication with your insurance coverage insurer throughout the process to deal with any concerns or even problems that might arise. The timeline for solving an insurance claim can easily vary relying on the complication of the situation, however your insurance coverage firm must maintain you educated of any kind of updates or choices regarding your claim. By remaining organized as well as proactive, you can easily aid quicken the insurance claims process and also get back on the roadway as rapidly as feasible.

Perks of Bundling Home as well as Car Insurance Plan

Bundling home as well as car insurance plans can supply multiple benefits to policyholders. By blending both policies under one insurance policy company, individuals can easily frequently acquire a savings on their overall insurance coverage superiors. This can bring about set you back savings in the lengthy run and simplify the insurance coverage settlement process through merging multiple policies with one insurance provider. Furthermore, bundling insurance may also supply insurance holders along with added comfort, as they merely need to manage one insurance coverage firm for any sort of changes, cases, or even queries to their policies.

Moreover, packing home and also car insurance can easily often lead to added benefits or gain from the insurance service provider. These might include special markdowns, enriched coverage possibilities, or concern customer care for policyholders that select to pack their policies. Some insurance carriers might likewise give incentives for loyalty, including additional markdowns or rewards for preserving multiple plans with the exact same company over a prolonged time frame. Through making the most of packing possibilities, individuals can easily not simply save cash however likewise possibly accessibility special benefits and also services from their insurance service provider.

Discovering the greatest Price Cuts on Car Insurance Policy in Dallas

When seeking the most effective discount rates on car insurance policy in Dallas, it is essential to take into consideration a few key aspects that can aid you spare loan while still getting the coverage you need to have. Among the most efficient means to locate markdowns is by bundling your car insurance coverage with various other plans, like home insurance. Lots of insurer give notable rebates for customers who have multiple plans along with all of them, therefore be actually certain to ask about packing possibilities when buying car insurance in Dallas. Additionally, sustaining a clean driving file may likewise aid you qualify for discounts, as insurer usually award risk-free drivers along with lesser rates.

Yet another technique to secure rebates on car insurance in Dallas is actually by taking benefit of any readily available savings for elements including being a really good trainee, having anti-theft gadgets set up in your vehicle, or perhaps belonging to specific organizations or groups. Through checking out all feasible methods for price cuts as well as being actually aggressive in inquiring about accessible savings possibilities, you may maximize your chances of locating the most ideal bargains on car insurance policy in Dallas. Keep in mind that comparing quotes from numerous insurance companies is additionally essential to ensure you're receiving the absolute most reasonable costs for the coverage you need to have.